Some of the same characters that played leading roles last time.

The value of the US home market has ballooned to $26 trillion. In many markets, prices exceed the earlier bubble that blew up or the peak. $14 trillion of that is in mortgage debt, equivalent to about 76% of US GDP. The numbers are – that is enormous and they issue.

But who’s doing the financing? More and more it appears to be nonbanks called “shadow banks”. They have now overtaken commercial banks “to catch a record cut” of government-guaranteed mortgages, Attom Data Solutions reported in its home report.

So subprime mortgages with low or no down payments.

And these shadow banks are different:

“[T]hey typically borrow from Wall Street hedge funds, private investors, or banks to make loans, then quickly sell these mortgages to Fannie Mae and Freddie Mac and other buyers, so they can repay their loans and start the process over again. Nonbank lenders dominate the origination of mortgages insured by the Federal Housing Administration (FHA) and by the Veterans Administration (VA), the riskier corner of housing lending due to no down payment or low down payment loans and poor-credit buyers.“

These government entities don’t actually make loans; they buy loans from lenders, package them into mortgage-backed securities, and guarantee them to make investors whole if the mortgages default.

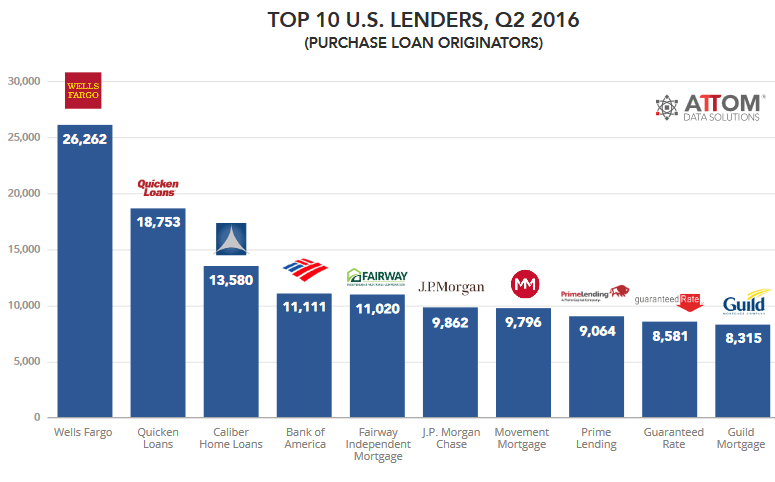

Wells Fargo is still the largest mortgage lender by far, with 26,262 purchase mortgage originations in the second quarter, according to ATTOM. Of these top ten originators, shadow banks originated 63% of the mortgages!

These shadow banks are barreling into the marketplace by going after more high-risk borrowers and authorities ensured no-down payment or low deposit mortgages, with impeccable time, now that the Fed’s monetary gyrations have inflated house prices nationally past the earlier bubble peak, and in many markets much beyond the prior bubble peak.

And some of the exact same characters that played leading parts in the last housing boom and bust have reappeared. Recall Countrywide? The report:

“In California, some of the largest nonbank lenders include PennyMac, AmeriHome Mortgage, and Stearns. All three are headquartered in Southern California, the epicenter of last decade’s subprime mortgage lending industry. And all three companies are run by executives who formerly worked at the once- giant Countrywide Financial, the now defunct subprime lender founded by Angelo Mozilo (Bank of America bought Countrywide for $4 billion in July 2008).

PennyMac, a fast-growing nonbank lender, is run by Stanford Kurland, a former Countrywide Home Loans executive and IndyMac director. Stearns, a Santa Ana, California-based nonbank lender, is run by Brian Hale, a former Countrywide division president. And Joshua Adler, who is AmeriHome’s managing director of secondary marketing, held similar roles at Countrywide and Bank of America.”

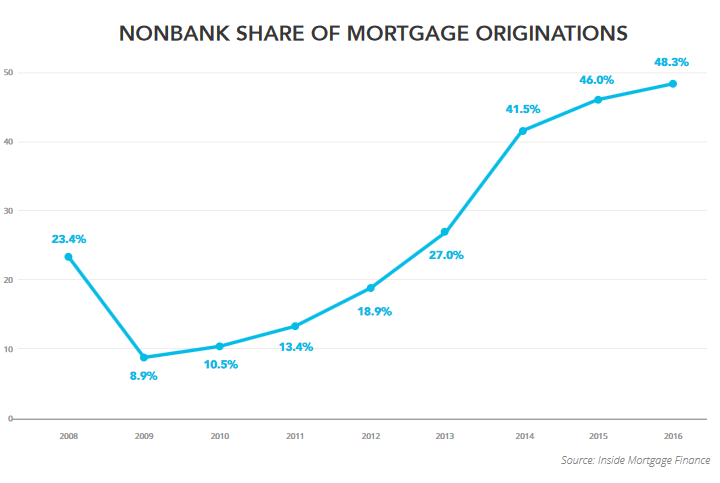

Banks still originate the majority of mortgages overall, but barely! Their share has dropped from 91% of originations in 2009 – after many of the shadow banks had collapsed in the housing bust – to 51.7% so far in 2016. The share of shadow banks (blue line) has soared to 48.3% (chart by ATTOM):

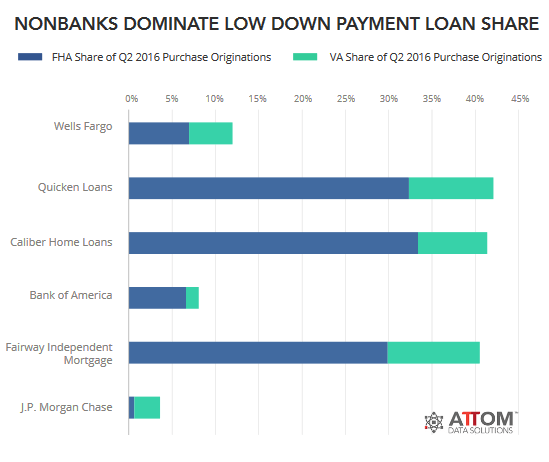

These shadow banks dominate in mortgages that are insured by the FHA and the VA, including no-down-payment and low-down-payment mortgages for buyers with subprime credit ratings, the riskiest mortgages out there. Thus, FHA and VA backed loans have jumped from 6% of all purchase originations in 2006 to 30% in Q3 2016.

“The big banks have restricted their mortgage business,” Guy Cecala, publisher and CEO of Inside Mortgage Finance, told ATTOM. “Instead, banks like Chase and Bank of America are making jumbo loans to more affluent borrowers. More than 50% of their business is jumbo loans.”

Jumbo loans are not insured by the government. Nonbanks and the government are picking up the rest.

Increasingly, the federal government – FHA, VA, Fannie Mae, Freddie Mac, and Ginnie Mae – has played a larger role in the mortgage financing industry as the large depository banks retreat from the home loan market. In all, these five entities own or have guaranteed more than $5 trillion in mortgage risk…”

The role of the government entities that insure high-risk subprime mortgages has soared: The FHA insured 3.4% of all mortgage originations in Q1 2006; by Q2 2016, its share had jumped to 17.5%. Over the same period, the VA’s share soared from 0.7% to 8.7%.

This chart shows the share of FHA and VA insured mortgages as a percent of total mortgage originations by lender. For example, of the mortgages Wells Fargo originated in Q2, 12% were FHA (blue) and VA (green) loans, compared to about 42% for Quicken Loans:

It truly is mostly via this conduit of the shadow banks the nationalization of the most high-risk end of the mortgage business is continuing. It has become entirely determined by government guarantees.

“The government is buying and guaranteeing 60% to 70% of all mortgages,” said Richard X. Bove, vice president of equity research at Rafferty Capital Markets. “The authorities possesses the mortgage marketplace. It’s a nationalized marketplace.”

This artificially shoves down mortgage rates as taxpayers bear the risk. Low mortgage rates and -down payment and low-down-payment subprime mortgages are just what is required drive Housing Bubble 2 to its peak and to inflate already inflated house costs further. It creates the foundation for the next housing bust, where citizens and/or the Fed, will once again bail out investors in mortgage-backed securities. Why? Because politicians, always excited to purchase votes, refuse to get the government from the mortgage business.

Yet we hear constantly, there’s no danger. Defaults are at a record low. Same as merely before the last housing bust. When house prices soar, no one defaults. You can just sell the house and payoff the mortgage. The trouble appears when prices head south. Alas, there’s just no letup in dismal tidbits piling up about the condominium markets.